WHAT IS SELLER FINANCING?

Before we discuss the process involved in creating a real estate note, it is important to understand the concept of seller financing. Seller financing is when the seller of a property takes the place of a traditional mortgage company or bank and lends money directly to the buyer. The buyer and seller sign a document defining the terms of repayment including the agreed upon interest rate, number of years to repay the loan and the monthly payment. This document is called a Real Estate Note.

WHAT IS A REAL ESTATE NOTE?

A real estate note is a promissory note, secured by a specified piece of real estate. It is a written promise to repay a specified sum of money, plus interest at a specified rate, and length of time, to fulfill the promise. The payment streams generated by seller financing a property can be sold, or assigned to other private investors for a profit.

STEP ONE: ACQUISITIONS

The first step to create a real estate note is to acquire a property below market value. The basic idea here is to acquire a property below market value in an area where a quality buyer would want to live. We give you our definition of a “quality buyer” and show you how to find them in our course. Click here for a free preview of our course.

Look for distressed properties that have the potential to be some of the nicest and most desirable homes in the community. This will ensure a quick sale.

STEP TWO: RENOVATION

Step two, is to make renovations to the property. The goal of the renovation project is to make the home one of the most desirable properties in neighborhood and deliver a home to the market that stands out as one of the nicest properties on the block.

We will teach you how to buy homes well below market value so that you have a healthy budget to invest into the home during the renovation process. This will ensure that your home will be easy to sell at market value and you will end up with a highly profitable real estate transaction. Buying a property below market value and renovating it properly, puts you in a great position to create a high yielding real estate note. In the complete version of the course, you will learn the number one mistake new investors make when trying to renovate a home.

STEP THREE: FIND THE HOME BUYER

Step three is to find the “right” buyer for the home. After renovations and improvements are complete, you want to put the house on the market offering “Owner Financing”. Owner Financing and Seller Financing are terms that can be used interchangeably.

Because of the huge demand for “seller financed properties” you typically will not have trouble finding someone that wants to purchase your home. The challenge is to select the right buyer who is willing to make a significant down payment and has the character and income documentation to justify selling them the home.

In the full version of the course we will go into much more detail on “Character Underwriting.” We will teach you how to attract and select the most “qualified” buyers to ensure that your notes get sold for top dollar.

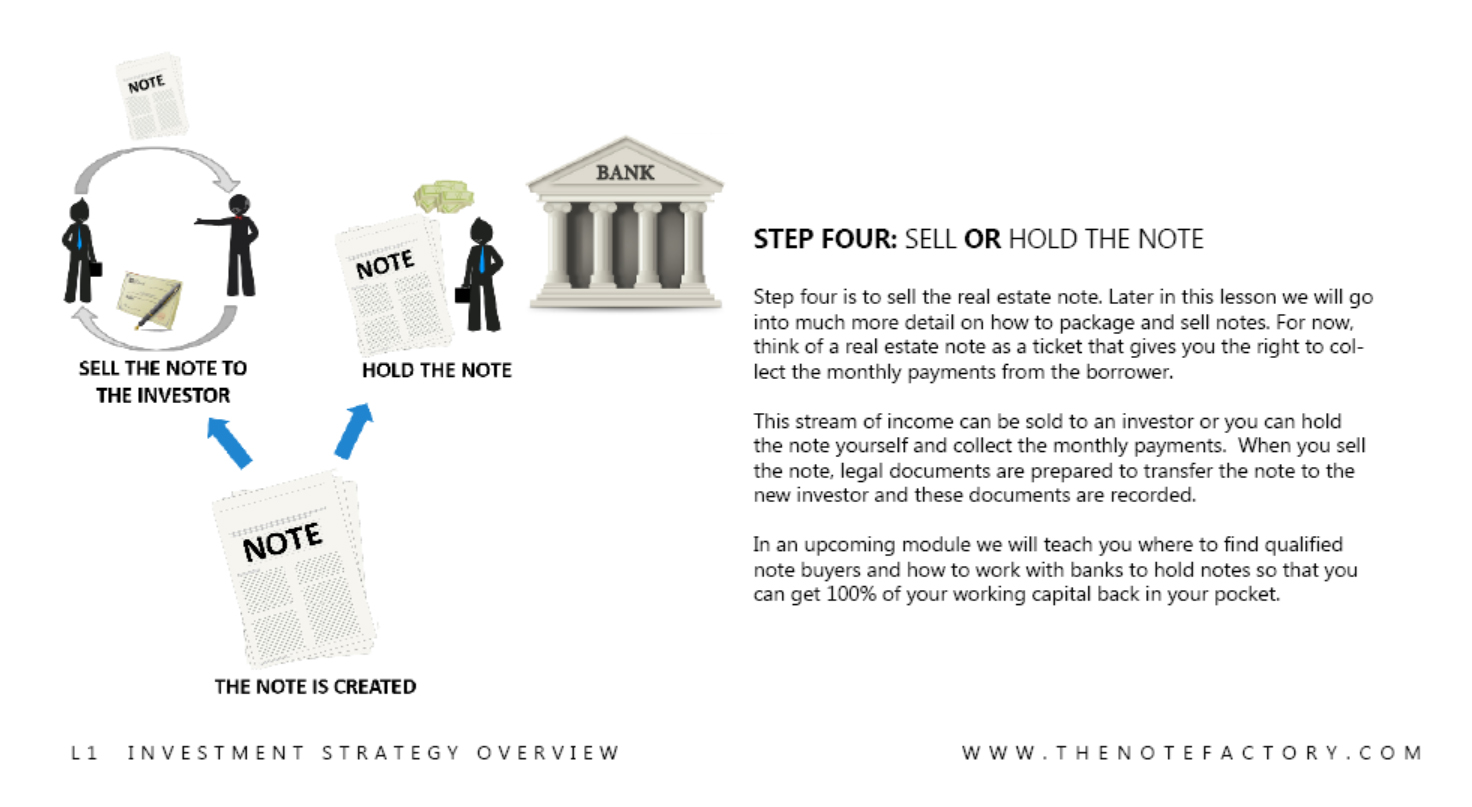

STEP FOUR: SELL OR HOLD THE NOTE

Step four is to sell the real estate note. In the course we will go into much more detail on how to package and sell notes. For now, think of a real estate note as a ticket that gives you the right to collect the monthly payments from the borrower.

This stream of income can be sold to an investor or you can hold the note yourself and collect the monthly payments. When you sell the note, legal documents are prepared to transfer the note to the new investor and these documents are recorded.

In the complete module we will teach you where to find qualified note buyers and how to work with banks to hold notes so that you can get 100% of your working capital back in your pocket.