In this issue of the Note Factory News we would like to share an excerpt from our new book "Stop Flipping, Stop Renting, Seller Finance Your Way to Financial Freedom."

We want to illustrate the value of a “great” recipe compared to a “good” recipe by showing you some compounded returns over time. Acquiring rental properties has been the investment vehicle of choice for many real estate investors trying to build passive income. We agree that rentals can be a pretty “good” recipe but definitely not as good as building a portfolio of real estate notes. Not only are the yields better, but with real estate notes you don’t have to deal with renters, repairs, property taxes, insurance and vacancy rates.

Most experienced investors that focus on renting properties would consider an 8% net return as very good performance of their portfolio. Our typical real estate notes, sold to our private investors, yields about a 12% net return. If you learn the steps to create your own notes, you could yield about 16%! These are the same dollars, just a different recipe.

One of the biggest reasons many investors choose to go the rental home route is because they can use leverage by getting a loan from a bank to enhance their returns. Guess what? You can leverage notes too and we can show you how...

Don't underestimate the power of earning a higher return over time. Take a look at the following numbers to see how earning a higher yield is the difference between an average retirement and an extraordinary one. The following example assumes you are reinvesting your annual return each year.

$100,000 invested at 8% for 30 years grows to: $1,006,265.69

$100,000 invested at 12% for 30 years grows to: $2,995,992.95

$100,000 invested at 16% for 30 years grows to: $8,584,987.69

Which path would you rather take? The average path of 8% or the extraordinary one at 16%. The time is going to go by either way. Don't settle for average in anything in you life!

ONLINE NOTE FACTORY INVESTMENT STRATEGY COURSE. FREE PREVIEW

WOULD YOU LIKE TO LEARN HOW TO CREATE AND/OR INVEST IN REAL ESTATE NOTES WITH THE NOTE FACTORY?

GET YOUR FREE ACCESS TO PREVIEW THE COURSE HERE:

www.thenotefactory.com/free-module-preview

WHEN YOU PURCHASE THE COMPLETE VERSION OF MODULE ONE, YOU WILL BECOME A MEMBER OF THE NOTE FACTORY ACADEMY AND HAVE ACCESS TO EXCLUSIVE ONLINE VIDEO LESSONS AND COURSE MATERIALS.

ACCESS TO OVER TWO HOURS OF INTERACTIVE ONLINE VIDEO LESSONS

+

90 PAGE COLOR MODULE BROCHURE

+

FREE INVESTMENT CONSULTATION WITH THE PRINCIPALS OF THE NOTE FACTORY TO DISCUSS HOW TO BUILD YOUR NOTE PORTFOLIO

IN MODULE ONE, YOU WILL LEARN...

HOW REAL ESTATE NOTES CAN BE YOUR TICKET TO MONTHLY PASSIVE INCOME.

WHY SELLER FINANCING HAS BEEN A SUPERIOR INVESTING MODEL COMPARED TO OTHER MORE CONVENTIONAL METHODS OF REAL ESTATE INVESTING IN OUR EXPERIENCE.

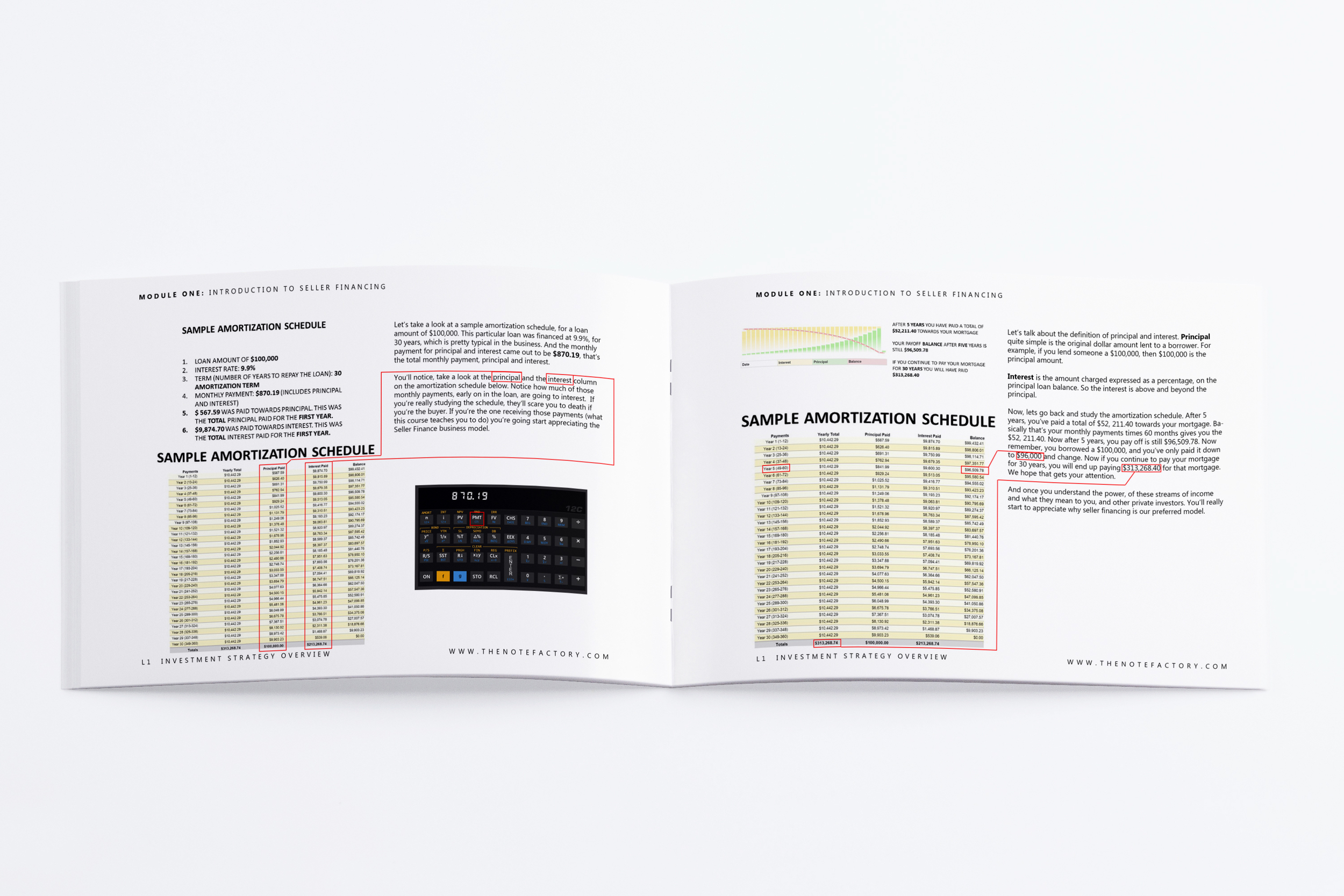

HOW TO USE THE POWER OF AN AMORTIZATION SCHEDULE IN YOUR NOTE INVESTMENTS

HOW TO USE REAL ESTATE NOTES TO BUILD PASSIVE INCOME FOR RETIREMENT.

HOW TO MAKE THE KEY CALCULATIONS THAT YOU NEED WHEN INVESTING IN AND CREATING PROFITABLE REAL ESTATE NOTES

THE LEGAL DOCUMENTATION YOU NEED IN ORDER TO COMPLETE YOUR TRANSACTIONS

AND MUCH MORE....

CLICK HERE TO LEARN MORE ABOUT WHAT YOU WILL LEARN IN THE COMPLETE MODULE ONE

WHETHER YOU ARE EARLY IN YOUR DEVELOPMENT OF CREATING STREAMS OF PASSIVE INCOME, OR YOU ARE A SEASONED INVESTOR LOOKING FOR A SUPPLEMENT TO YOUR PORTFOLIO, THIS MODULE WILL TEACH YOU A SYSTEM THAT CAN PRODUCE STREAMS OF MASSIVE PASSIVE INCOME YIELDING DOUBLE DIGIT RETURNS ON YOUR MONEY

THROUGHOUT THE MODULE, THE PRINCIPALS OF THE NOTE FACTORY INTERJECT WITH PERSONAL VIDEO INSTRUCTION EXPLAINING THE KEY TOPICS COVERED IN THE LESSONS.

“After taking Module One, I saw the power of note investing the with The Note Factory. I would highly recommend any investor serious about taking control of their portfolio to educate themselves on this amazing passive income vehicle.”

-Note Factory Investor

We look forward to seeing you in Module One...

Please provide feedback on the lesson by using the button in the upper right corner of the course screen. Also feel free to share the link below with you friends and colleagues so they can gain access to the free material as well.